Open a Checking Account

Serving Bartlesville since 1939, and nearby towns like Dewey, Nowata, and Pawhuska, Truity Credit Union offers checking accounts with no minimum balance, ATM fee refunds, and perks like identity theft protection. Apply online in minutes or visit our Bartlesville branch to get started.

Discover Your Ideal Checking Account

Looking for business checking accounts?

Free Services

Included With All Our Checking Accounts

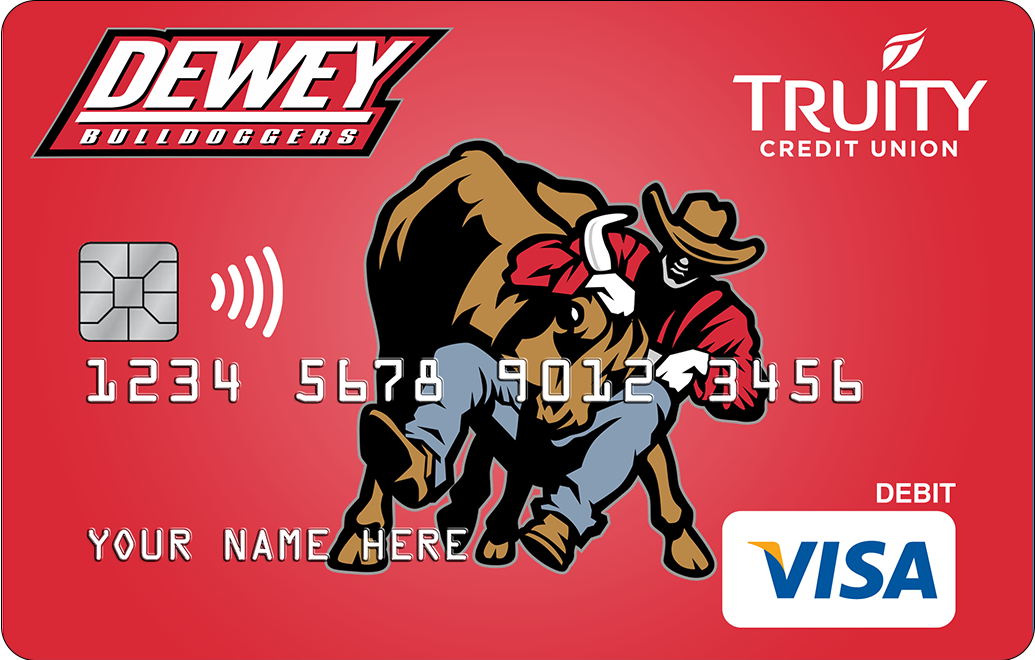

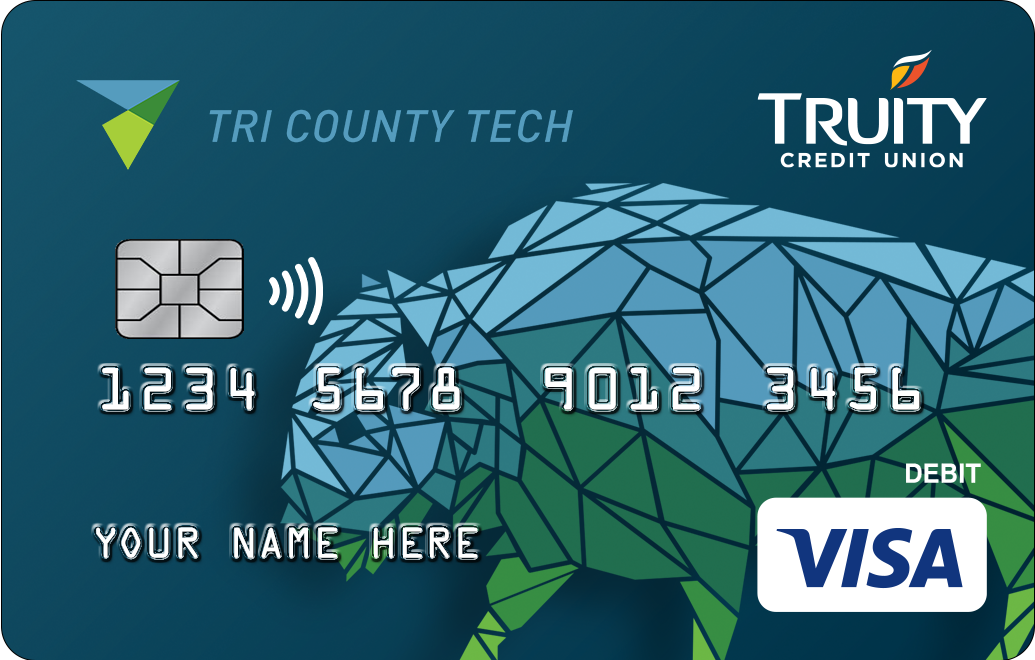

Choose from any of our Spirit Cards and support local schools or charities with each swipe or tap!

Dewey Bulldoggers

Supports Dewey Public SchoolsPawhuska Huskies

Supports Pawhuska Public SchoolsTri County Tech

Supports Tri County TechWoolaroc

Supports Woolaroc Museum & Wildlife PreserveIncluded Features

Award Winning Service

We strive to provide you with exceptional service, and it shows! Our communities, members and employees have ranked us as a top-performing financial institution.

Disclosures

2. A minimum opening deposit of $5,000 is required. A $20 service charge will apply each month the average daily balance falls below $5,000.

9. Truity ATMs are always free. Out-of-network ATM surcharge reimbursements will be credited to the qualifying account at the end of each calendar month in which twenty or more debit card purchases were made.

21. MONITORING SERVICES ARE PROVIDED TO THE PRIMARY ACCOUNT HOLDER ON AN ENTITLED BASIS AND REQUIRE CONSUMER ACTIVATION. For additional details about the services, including terms, conditions and limitations, please visit https://truitycu.nxgstrategies.com/

22. To meet the transaction requirement, use your Truity debit card wherever Visa is accepted, including online purchases or payments. ATM transactions will not apply.

25. Essential Checking is FREE.

39. Available only on eligible loans, including personal, direct auto or other secured loans when you have an active Preferred or Advantage checking account and automatic payment from a Truity share. Lines of credit, credit cards, and existing Truity loans are not eligible. One discount per loan; with approved credit.

41. Benefit up to $500 minus a $50 deductible; two claims per year (12-month period). The primary account holder can file a claim for any phones owned by them. For additional details about the services, including terms, conditions and limitations, please visit TruityCU.nxgstrategies.com.

49. Preferred Checking is FREE, or $5.00 monthly service charge if less than 20 debit card transactions per month.

71. Truity Credit Union Members are eligible for the Greenlight SELECT plan at no cost when they connect their Truity account as the Greenlight funding source for the entirety of the promotion. Upgrades will result in additional fees. Plans start at $4.99/mo. See terms for details. Offer subject to change or renewal.

72. Truity Credit Union may make incoming electronic deposits available for use up to two banking days before the scheduled deposit date. Weekends and federal holidays are not banking days. Early availability of deposits depends on when the notification of the deposit is received by Truity. This notification can vary and is under the control of the payer of the deposit – not Truity Credit Union. Early deposit is not a contractual obligation and does not guarantee future early deposits.

73. Annual Percentage Yield (APY). 5.00% APY is paid on balances up to $5,000; .10% APY is paid on balances over $5,000 for a blended overall rate; rates effective 5/1/24 and subject to change. The following account qualifications must be met to earn the qualifying APY: (1) Twenty (20) debit card transactions must clear the account, and (2) a total of $1000 in direct deposit into this checking account by the end of the month. If both are not met, .10% APY will be paid on the balances. One High Yield Checking per account.